Santos, the largest shareholder in PNGLNG is in the picture for the $80 billion merger talk with Woodside Energy

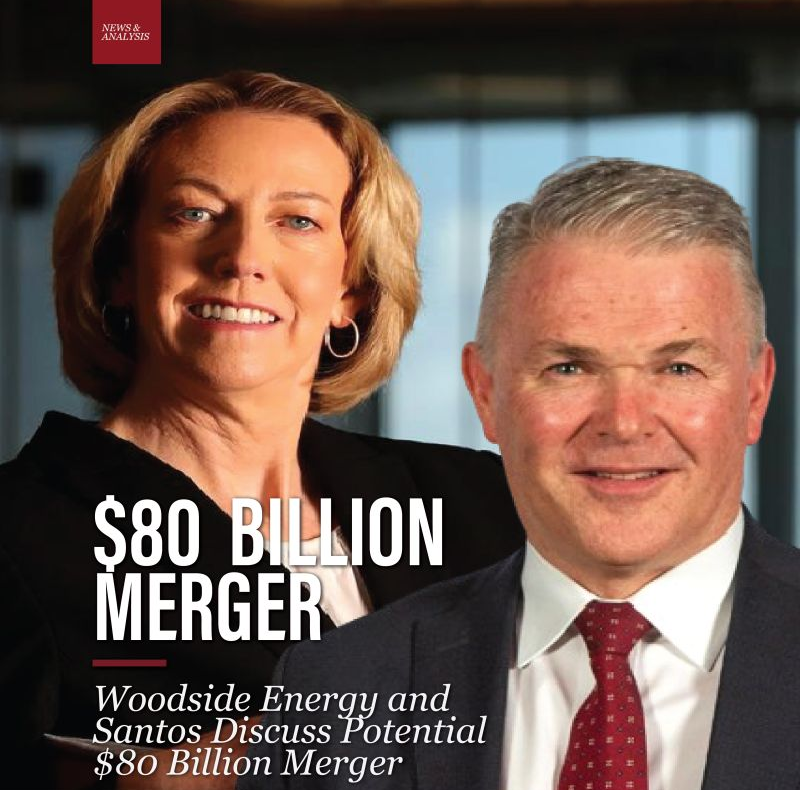

Woodside Energy and Santos, both significant players in Australia’s oil and gas industry, are in early discussions for a potential merger that could create a $80 billion energy giant.

This potential merger aligns with a global trend where oil and gas companies are consolidating to address challenges like reducing carbon emissions and navigating obstacles in expanding their projects.

If the merger proceeds, it would consolidate assets previously held by four different companies, including notable entities like Oil Search and BHP Petroleum, significantly reshaping the industry.

“Santos continuously reviews opportunities to create and deliver value for shareholders,” says Santos CEO Kevin Gallagher.

“We’re looking at every avenue to unlock shareholder value. We’re very frustrated at our share price—it’s stalled, and we need to un-stall it.”

Woodside, led by CEO Meg O’Neill, faces hurdles in securing final approvals for its major project, the $16.5 billion Scarborough venture in Western Australia, following its recent merger with BHP’s oil and gas arm.

Despite recent share price declines due to falling oil prices, market analysts view Santos’ exploration of alternatives positively, anticipating potential divestments or a takeover while maintaining a growth-focused strategy.

Both companies clarified that discussions are in their early stages, exploring various structural possibilities. They stressed that these talks are ongoing, confidential, and no definite transaction has been reached.

Woodside, valued at about A$57 billion ($37 billion), aims to expand its growth opportunities to meet sustained oil and gas demand. Santos, valued at A$22 billion, has announced collaboration with advisors to enhance its overall value.

Woodside is the leading liquefied natural gas (LNG) exporter in Australia, competing with the US and Qatar. A merger between Woodside and Santos would create one of the world’s largest energy producers in the world.

Woodside recently acquired BHP Group Ltd.’s oil and gas division for a mouth watering $20 billion and operates across various regions, including Australia, the US, and Trinidad. The company is pushing forward with projects totaling around $24 billion, with its prominent focus on advancing the Scarborough LNG development.

Meanwhile, Santos completed a $15 billion acquisition of Oil Search recently and possesses assets including share in PNGLNG in Papua New Guinea and operational facilities in Australia. The company is actively developing the Barossa gas field off the coast of the Northern Territory, alongside a significant project in Alaska.

Photo Credits: Woodside CEO Meg O’Neill (left), Courier Mail: Santos CEO, Kevin Gallagher (right), The West Australia

Related posts:

- $6.3M TOTAL CAPITAL: Touch2Pay Hits $6.3M Total Capital with $3.2M Pre-Series A2 Funding Closure

- A $2M BET BECOMES 42 BILLION: How Bryan Slusarchuk’s $2 Million Bet Turned Into $2 Billion with K92 Mining in Papua New Guinea

- PNG Customs Services Implements Tax Relief Measures on Consumer Goods

- Porgera Mine: K26 Billion Windfall or Deja Vu? A PNG Gold Rush with a Checkered Past